Your Mortgage Made Easy.

Get your easy, hassle-free digital mortgage here.

GETTING A HOME LOAN SHOULDN’T BE HARD

SEE HOW SIMPLE IT IS

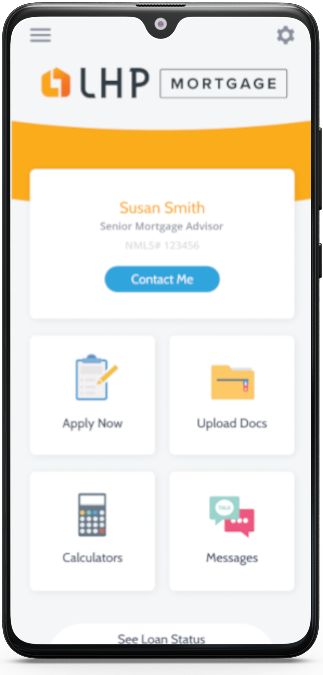

The Loanzify App guides you through your mortgage financing and connects you directly to your loan officer and realtor.

MORTGAGE PAYMENT CALCULATOR Calculate how much your monthly mortgage payment could be.

* Results are hypothetical and may not be accurate. This is not a commitment to lend nor a preapproval. Consult a financial professional for full details.

FHA, First-Time Home Loans, VA, Conventional Loans in League City, Texas

Welcome to our site. We are a full-service mortgage company based in League City, Texas. We specialize in FHA, First Time Buyer Home Loans, Conventional, and VA Loans in League City, Texas. We also serve the surrounding cities in Galveston County and greater Houston area. Whether you are buying a home or refinancing in the zip code of 77573, we can help you realize your dream of home ownership or save you money when getting your new lower monthly payment.

In terms of Purchase Loan programs, we offer the following:

Refinancing? We can help you with that, too!

We offer a wide range of refinancing options, designed to best meet the needs of local borrowers. If you're looking for cash out, or to just get a better rate and term, we can assist you. We offer the following Refinancing Programs:

What makes us unique is that we also offer the following niche programs: MCC Tax Credit, FHA loans with credit scores as low as 620, and down payment assistance options

Contact Baymont Mortgage today to discuss your mortgage loan options, and find out which loan program will best suit your needs.

@baymontmortgage Your Super Friends in Lending #BaymontMortgage #YourFriendsInLending #MortgageMimi #LeagueCityTx ♬ Power Up - Super Sound